Dear Coffee Readers,

I have been drinking a lot of coffee lately. Every time I sit to write about a topic for this blog, events catch up to my forecasts. And so, I scrap one draft of Coffee after another and just continue to drink more of it. But now, finally, we are at an inflexion point and we need to talk!

Three banks (Silvergate, SVB, and Signature) failed recently, stunning the markets. Credit Suisse was bailed out that next weekend. And now First Republic was seized by the FDIC and sold to JP Morgan (ala Bear Stearns in 2008). Stalwarts like Deutsche Bank and even Charles Schwab are also being spooked by financial market turbulence.

Last Sunday I watched Bloomberg to get a handle on what the markets may do come Monday morning. Many pundits, commentators, and asset managers gave their opinions and then cautioned, “I don’t know what the Fed sees in its crystal ball.” The conclusion of the panel was the Fed has no crystal ball. One pundit noted, “If it did, it wouldn’t be wrong so often.”

Grab a cup of Joe, and I will share what my crystal ball is telling me about inflation, interest rates, and the state of the real estate markets.

Blind Man’s Bluff…

The Fed broke the banks. That is not to say that these banks were managed well. But the aggressive interest rate hikes – the largest in 40 years – exposed these banks to treasury and other asset risk. I originally assumed this result was intentional. After all, the Fed has made clear that part of its anti-inflation plan was to devalue assets that became artificially bloated during the dovish days of the pandemic. Why wouldn’t bank-held assets, like Treasuries, bonds, and real estate be in the Fed’s crosshairs? Plus, pressuring the banks to restrain lending is a natural way to suck liquidity out of an overstimulated market.

Within days, my original assumptions were all proved wrong. It soon became clear that the Fed didn’t plan this result at all. The Fed’s own bank stress tests did not include an analysis of interest rate risk even as it was overseeing a strategy of rapid and historic interest rate increases. It is remarkable that the Fed Board of Governors and its staff, comprised supposedly of economic experts and financial analysts, simply neglected to examine the relationship between the largest interest rate increases in four decades and the asset devaluation risk of the banks they regulate. I shake my head stunned and fearful that the Fed is also acting blindly on its other decisions.

Kick The Can…

Yet, as remarkable as the Fed’s miss on bank risk has been, it is only one of a long-term series of missteps relying on old economic models to analyze all-new economic realities. The Fed is confused by (or is ignoring) Main Street signals that the economy and inflation are slowing. Let’s first focus on the data. The Fed is reacting to data it sees in the rear-view mirror. For example, labor is a trailing indicator. Yet, the Fed is watching every nuance in the labor market as if it were a leading indicator.

If it just tracked the corporate layoff announcements, which are harbingers of future job losses, it would see the labor rate will be declining over the next few months. And I will tell you what the press is not reporting – yet. Thousands of tech startups are too small to make the news, but their access to private equity has been severely curtailed. When SVB failed, the lines of credit that helped finance these startups went up in smoke. Out of favor with private equity, and with lines of credit gone, they can’t rely on subsequent rounds of funding to pay for their massive startup deficits. Hundreds of these companies must lay off much of their workforce or, if they don’t, they will soon become insolvent and close their office doors on even more workers.

The largest source – about 30 percent – of new jobs being reported are in hospitality. But there aren’t thousands of new hotels being delivered requiring a larger workforce. If anything, very few new hotels are in the pipeline. What’s happening post-covid is that existing hotels are returning to normal operations. Nothing more. To construe these jobs as inflationary or signs of a booming economy is to misread what is happening on Main Street.

A recent industry report demonstrates that the number of hotel jobs today is still down significantly from the halcyon days of 2019. These new jobs, and even jobs reported in other sectors like healthcare, are not the result of a runaway economy. GDP has been quite low and last quarter it was a mere 1.1 percent. These are some of the reasons I contend that employment numbers are just being misinterpreted. If the Fed wants to focus on data – consumer spending is down, and credit card delinquencies are rising, along with mortgage defaults. Inflationary? Hardly.

Crack The Whip…

Other signs that inflation will be trending down over time include the cost of the vital infrastructure that underpins our economy and can foretell future pricing pressure. Consider Energy. Despite the war in Ukraine and Saudi production cuts, shipping costs have returned to pre-pandemic levels. Meanwhile, supply chains are less stressed, assuaging supply demand distortions. Housing costs, which are a huge component of CPI, have stabilized, if not come down. However, the Fed measures housing costs improperly, using outdated methods on a good day, and data that are six months old when published.

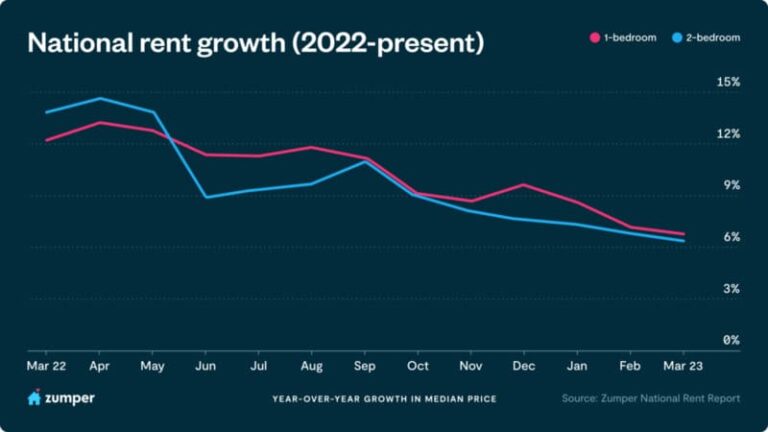

Here is another concern – housing is 30 percent of CPI. Yet, most reports show rents have stopped growing, and in some markets, rents are coming down (and this doesn’t include the cost of concessions.) Yet, these lower housing costs are not showing up in the CPI. Instead, the Fed is reporting increasing housing costs. One reason is for this: we are measuring rents in March 2023 to rents in March 2022. Those rents are up year over year. But rents since October have trended down nationally. It is a mistake to miss the trends of these more recent months.

Hopscotch…

As troubling, the Fed is inputting this out-of-date data into antiquated models to analyze sui generis problems. In the old days, inflation was a result of an overheated economy. With GDP this low, the economy is not overheated at all. Instead, inflation was caused by financial stimulus and an uneven opening of the global economy. Yet, the money supply is constricting, and global supply chains are being resolved.

What the models don’t appreciate are the new economic circumstances we are confronting all at the same time. For example, this is the first time in modern history that a smaller generation of workers is replacing the largest generation in the workforce. It’s the first time we are rapidly replacing carbon-based energy with green energy, running both at full speed at the same time. We are experiencing the reopening of a global economy that was shut down by governments worldwide literally overnight. Where is the Harvard case study on that?

It’s the first time the Fed balance sheet has been this high, or that the US ever pumped trillions of dollars into the economy in a matter of weeks. All the while, supply chain issues have shocked industry to “re-shore” production in the US. That too drives up costs. We are also seeing record migration from high-tax to low-tax states, causing disruptions in housing supply in some parts of the country such as the southeast. For example, remove rent from March CPI in Florida, where northerners are migrating in record numbers, and inflation there would have been just in the 3 percent range.

To add even more uncertainty, the war in Ukraine is radically affecting global markets in energy and food. It has also resulted in the redirection of tremendous resources into military production for the first time in decades. There are significant financial repercussions to all these first-time or unique events. Does the Fed have economic models to read these uncommon first-in-our-lifetime events accurately? I don’t believe they do. The Governors can’t even appreciate what the Fed’s own rate increases are doing to the value of bank-held assets they oversee!

Moreover, we have been measuring inflation, not against the previous month, but against prices for the same period of the prior year The first month inflation was reported was April 2021. Hence, this will be the first month in the last twelve that the Fed’s antiquated CPI report will be measured against a month that has reported inflation two years in a row. April will be the month we are measuring inflation against an already inflated number. But housing costs will still be reported six months in arrears. Rents stopped their torrid rise in October. We also know rents have stopped growing in most markets (rents are reported down over two percent in Q1 in the US). Home purchase pricing has been down for months, but later this month the Fed will report housing costs from early autumn data before those costs really began dropping. Yet, disinflation in housing is here, now.

Connect Four…

I never claimed to be an economist. But I see real-time data and am a lifelong student of history. I have called the economy right for many years often opposing the conclusions of the Fed and other self-named experts. In my view; inflation is about done. We will see it reduced in April’s numbers as we compare apples to apples. And, even using the Fed’s old system, by the fall housing costs will catch up with the Fed’s methodology and drag down CPI considerably. The Fed may raise rates once or twice more, possibly this week. They shouldn’t, but they could. Either way, the Fed tightening policy cycle has about topped out.

Real estate is being affected by the Fed’s historic interest rate escalations. We are seeing increased payables at multifamily properties in the market. Interest rate caps are not being renewed because sponsors did not accrue for the huge interest rate hikes. And, of course, interest on adjustable-rate loans has skyrocketed. Add to that the high basis many owners paid in 2021, and opportunity may be around our corner.

Few deals of any kind are on the market. And there is still a lot of equity sitting on the sidelines. So, I don’t expect a 2009 redux. But soon, owners will realize the “Hope Section” of their business plans is a very short chapter indeed and they will be forced to sell or give back their properties to their lenders. Inklings of this distress are slowly being reported. At some point, all these pressures will bubble up into the market. When that happens, RADCO will be waiting patiently to capitalize on the new opportunities that may be around the corner.I will resume this blog on a more regular basis, so stock up on your favorite blend.

Best Regards,

Norman